The recently passed child tax credit expansion is facing hurdles in the Senate as skeptical Republicans aim to derail the proposal, leaving advocates and parents concerned about the future of this much-needed assistance.

Child Tax Credit Expansion Faces Uncertain Future in Senate

The recently passed child tax credit expansion is facing hurdles in the Senate as skeptical Republicans aim to derail the proposal, leaving advocates and parents concerned about the future of this much-needed assistance.

The Senate Becomes an Unexpected Roadblock

The Senate, typically not associated with such delays, has become an unexpected roadblock to the child tax credit expansion. Advocacy groups are increasing pressure on skeptical Republicans before they return from recess on April 8, urging lawmakers not to revise the bill to appease opponents and cause further delays in aid for struggling families.

If the measure fails to pass, it could be well over a year before Congress takes up a similar proposal. Families in need require immediate relief as the cost of living continues to rise.

The Impact of the Child Tax Credit Expansion

The proposed child tax credit, applicable to the 2023 taxes that families are currently filing, is not as comprehensive as the one passed in 2021. However, experts believe it would still help reduce child poverty, which has increased since the larger benefit expired.

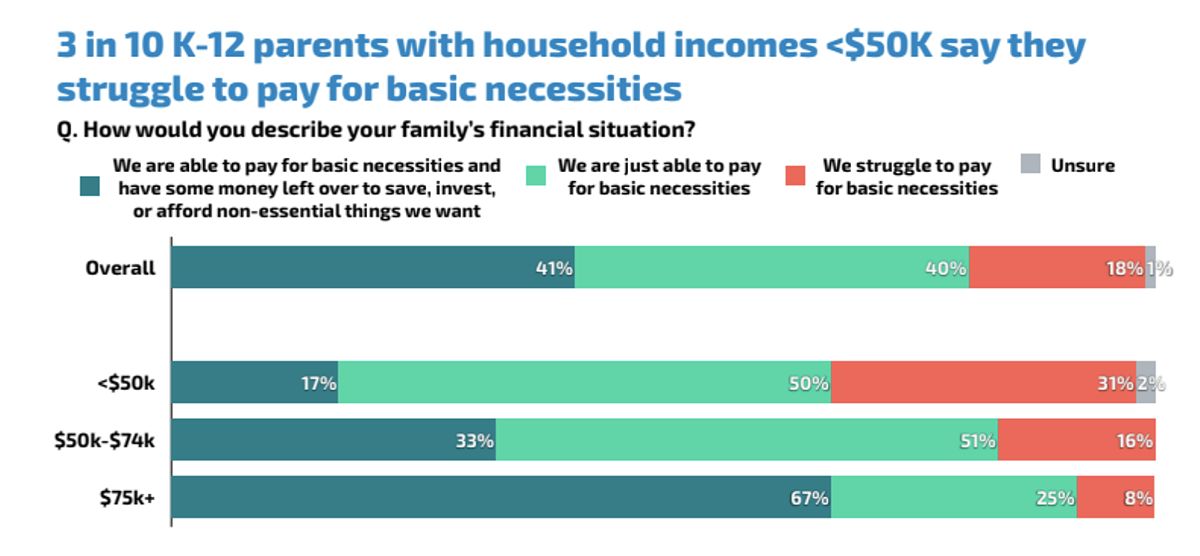

The 2021 pandemic credit successfully halved child poverty rates according to Census data, providing families with up to $3,600 per child in monthly payments. These payments allowed parents to rely less on food pantries and afford basic necessities. However, Democrats were unable to secure permanent support at that level.

The Proposed Child Tax Credit Expansion

The current bipartisan deal aims to gradually increase the refundable limit from $1,600 to $2,000 per child by 2025. It also seeks to ensure that parents receive the maximum benefit for each of their children, regardless of family size.

Under this proposal, a single mother of two earning $15,000 a year would receive $3,600 on her 2023 taxes and $3,750 the following year.

Opposition and Support

Republican Senator Mike Crapo strongly opposes a provision that would allow families to still earn the credit even if they work less, arguing that it transforms the program into an entitlement rather than one that rewards work. Senate Minority Leader Mitch McConnell appears to back Crapo's position.

However, advocacy groups point out that the proposed expansion has broad support among parents from both parties. The inclusion of pro-business benefits should make the overall package appealing to Republicans.

The Economic Implications of the Child Tax Credit Expansion

The child tax credit expansion is not only crucial for struggling families, but it also has significant economic implications. By providing support for childcare, education, and basic necessities, it can alleviate financial burdens and improve the local economy.

The Hope for Immediate Relief

As the fate of the child tax credit expansion hangs in the balance, advocates and parents are hopeful that lawmakers will prioritize the well-being of millions of children and pass this much-needed legislation. Time is of the essence, and families cannot afford to wait any longer for the relief they desperately need.