Neuralink, a neural interface technology company founded by Elon Musk, is at the forefront of merging the human brain with technology. Through their research and development, they aim to create a groundbreaking fusion of biology and computational power. While Neuralink is not available for public investment at the moment, there are indirect ways to explore the neuroprosthetics sector. Companies like Alphabet Inc., which has investments in Neuralink through Google Ventures, offer potential investment opportunities. Additionally, the VanEck Bionic Engineering UCITS ETF focuses on bionics, while the iShares Neuroscience and Healthcare ETF (IBRN) specializes in neuroscience innovation. Although Neuralink is not currently publicly traded, its recent successful implantation of a Neuralink device in a live human subject shows promising initial data. With a valuation of $5 billion, Neuralink may consider an initial public offering in the future.

The Vision of Neuralink

Neuralink, founded by Elon Musk, is on a mission to revolutionize the way we interact with technology by merging it with the human brain. Their vision is to create a seamless integration between biology and computational power, unlocking endless possibilities for human potential.

By developing neural interface technology, Neuralink aims to enhance cognitive abilities, treat neurological disorders, and even enable communication between humans and artificial intelligence. With this ambitious vision, Neuralink is pushing the boundaries of what is possible in the realm of neuroscience and technology.

Investment Opportunities in the Neuroprosthetics Sector

While Neuralink itself is not available for public investment, there are indirect ways to explore the neuroprosthetics sector. One option is to consider investing in companies like Alphabet Inc., which has investments in Neuralink through Google Ventures. This provides investors with exposure to the cutting-edge research and development happening in the field of neural interfaces.

Another avenue is through ETFs that focus on bionics and neuroscience innovation. The VanEck Bionic Engineering UCITS ETF offers a diversified portfolio of companies involved in bionics, while the iShares Neuroscience and Healthcare ETF (IBRN) focuses on U.S. and non-U.S. companies driving innovation in neuroscience.

By investing in these companies and ETFs, investors can participate in the growth of the neuroprosthetics sector and potentially benefit from the advancements made in the field.

The Future of Neuralink

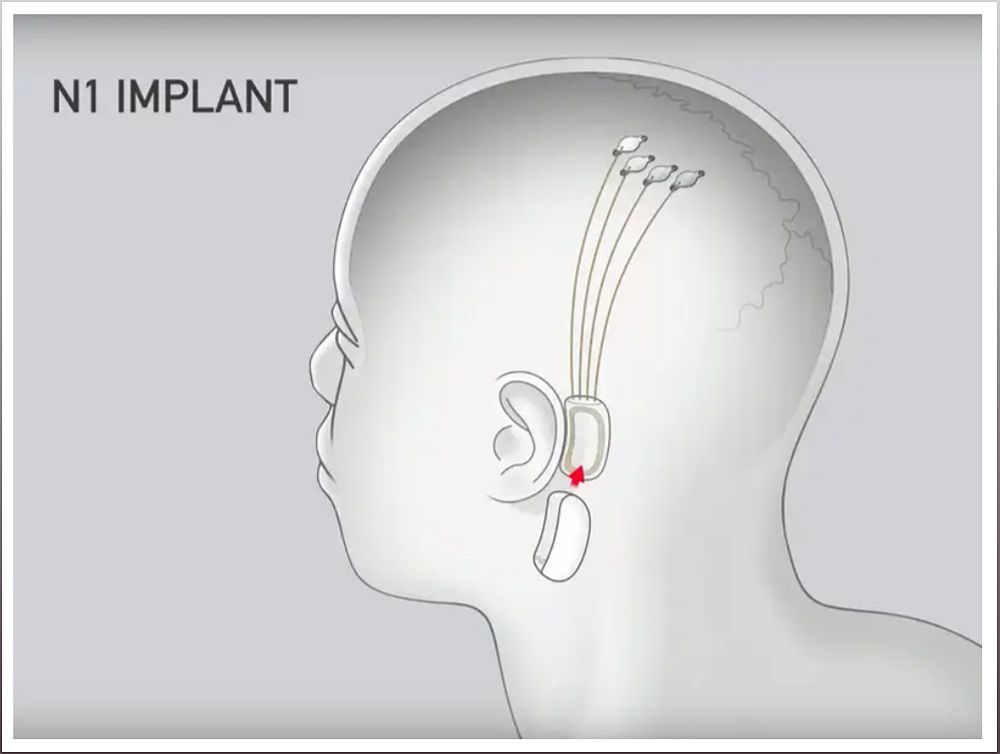

Although Neuralink is currently privately owned and not publicly traded, its recent success in implanting a Neuralink device in a live human subject is a significant breakthrough. This achievement provides promising initial data and paves the way for further advancements in the field of neural interfaces.

With a valuation of $5 billion, Neuralink may consider launching an initial public offering (IPO) in the future. However, it is widely believed that this is unlikely to happen in the near term. Nonetheless, the company's groundbreaking work continues to generate excitement and intrigue, as it pushes the boundaries of what is possible in merging the human brain with technology.

As Neuralink continues its research and development efforts, the potential applications and impact of their technology are vast. From enhancing human cognition to treating neurological disorders, the future of Neuralink holds the promise of transforming the way we interact with technology and unlocking new frontiers of human potential.